Market downturns, like this one, are to be expected

It's been awhile since there's been a drop in the markets as sharp, broad and sudden as last week's.

A recap of where we stand

US markets fell 3.1% (as measured by the Standard and Poor's 500 Index), on Wednesday, followed by greater declines in Asia. The impact to European markets was more muted. The S&P 500 was down an additional 2.06% on Thursday. The Australian sharemarket wasn't immune, falling some 2.7% during Thursday's trading day.

What's behind the rout?

After an extended period of relative calm and steady market gains, we're entering a period when investor sentiment is getting shakier. Geopolitical tensions between the US and China are ratcheting higher, nervousness is increasing about the approaching US corporate earnings season and US interest rates are climbing.

Taking a step back for some perspective

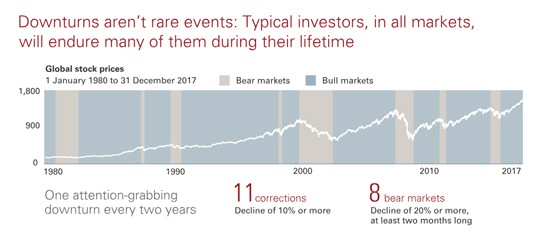

It's important to remember that corrections and bear markets happen often. From 1980 through 2017, there were 11 market corrections and eight bear markets in global stocks. That means on average there's been one attention-grabbing downturn every two years.

Another lesson from history is that stock market sell-offs related to geopolitical events have often been short-lived.

Some of the investor angst may be related to the belief that rising interest rates are a harbinger of poor stock returns. The reasoning goes that higher rates make bonds relatively more attractive compared with stocks and that they put a brake on economic growth, which in turn weighs on corporate profits. Vanguard research, however, suggests otherwise. We looked at 11 periods of rising rates over the past 50 years and found that stock market returns were positive in all but one of them. In addition, those periods together produced an average annualised return of roughly 10%—not a performance to be feared.

High stock valuations have been a concern as well, especially since the start of 2018. The recent market decline, in that context, is a sign that valuations are moving closer to fair value—a healthy adjustment that leaves more room for upside.

Advice for weathering the markets' ups and downs

Staying informed about market events is prudent, but so is maintaining a long-term view. Investors who already have a sensible investment plan designed to carry them through good markets and bad will hopefully have the discipline and perspective to remain committed to it despite this downturn.

Doing so will probably result in better investment outcomes than giving in to the temptation many investors may have right now to head for the exits. Market timing rarely turns out well, as the best and worst days often happen close to each other. In many cases, timing the market for reentry simply results in selling low and buying high.

Even with the latest market pain, patient investors with broadly diversified portfolios who rebalance and keep an eye on investment costs are likely to be rewarded over the next decade with fair inflation-adjusted returns.

16 October 2018

vanguardinvestments.com.au

Latest Newsletters

Hot Issues

- Aged care report goes to the heart of Australia’s tax debate

- Removed super no longer protected from creditors: court

- ATO investigating 16.5k SMSFs over valuation compliance

- The 2025 Financial Year Tax & Super Changes You Need to Know!

- Investment and economic outlook, March 2024

- The compounding benefits from reinvesting dividends

- Three things to consider when switching your super

- Oldest Buildings in the World.

- Illegal access nets $637 million

- Trustee decisions are at their own discretion: expert

- Regular reviews and safekeeping of documents vital: expert

- Latest stats back up research into SMSF longevity and returns: educator

- Investment and economic outlook, February 2024

- Planning financially for a career break

- Could your SMSF do with more diversification?

- Countries producing the most solar power by gigawatt hours

- Labor tweaks stage 3 tax cuts to make room for ‘middle Australia’

- Quarterly reporting regime means communication now paramount: expert

- Plan now to take advantage of 5-year carry forward rule: expert

- Why investors are firmly focused on interest rates

- Super literacy low for cash-strapped

- Four timeless principles for investing success

- Investment and economic outlook, January 2024

- Wheat Production by Country

- Time to start planning for stage 3 tax cuts: technical manager

Article archive

- January - March 2024

- October - December 2023

- July - September 2023

- April - June 2023

- January - March 2023

- October - December 2022

- July - September 2022

- April - June 2022

- January - March 2022

- October - December 2021

- July - September 2021

- April - June 2021

- January - March 2021

- October - December 2020

- July - September 2020

- April - June 2020

- January - March 2020

- October - December 2019

- July - September 2019

- April - June 2019

- January - March 2019

- October - December 2018

- July - September 2018

- April - June 2018

- January - March 2018

- October - December 2017

- July - September 2017

- April - June 2017

- January - March 2017

- October - December 2016

- July - September 2016

- April - June 2016

- January - March 2016

- October - December 2015

- July - September 2015

- April - June 2015