AFP teams up with ATO, Treasury in COVID-19 tax fraud taskforce

The Treasury has confirmed that it will be working with the ATO and an Australian Federal Police taskforce in investigating any cases of fraud related to the government’s COVID-19 stimulus measures.

Fronting a Senate inquiry into the government’s response to COVID-19, Treasury Deputy Secretary Jenny Wilkinson confirmed that her department has been involved in discussions with a fraud taskforce established by the Department of Home Affairs.

“I am aware there is a fraud taskforce which is sitting within the Department of Home Affairs and I know the Australian Federal Police are involved in that taskforce and it is also the case that the ATO and Services Australia are involved in those discussions,” Ms Wilkinson said.

The Treasury’s confirmation comes after Home Affairs Minister Peter Dutton had warned businesses that any attempt to fraudulently access stimulus measures, including the JobKeeper payment, would be dealt with swiftly by the new AFP taskforce.

“Those people need to hear a very clear message: now more than ever, you are likely to be caught,” Mr Dutton told 2GB radio.

“If people do the wrong thing, they can expect a search warrant to be executed by the AFP and they can expect their assets to be frozen.

“With those people who claim with good intent but have done the wrong thing, they will have to repay that money, but the criminals who exploit the system, the technology that we’ve got now to look at algorithms, look at transfers, to look at money diverted to different shelf companies — those people will be under a lot of scrutiny. They should think twice about what they’re doing.”

The ATO has been unequivocal about fraudulent schemes, warning that it will pursue action against business and agents that engage in such arrangements.

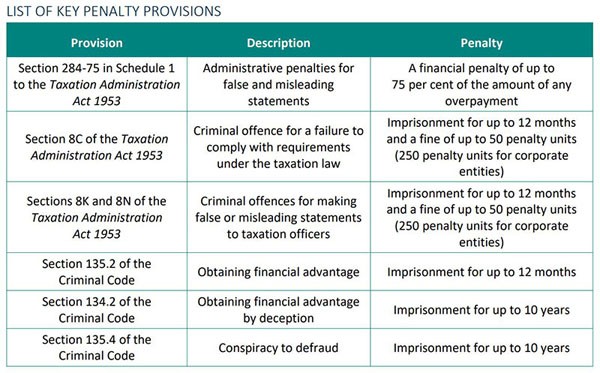

This image highlights some of the targeted schemes listed by the Australian Tax Office, schemes that may be used to artificially create or inflate an entitlement to the cash-flow boost, and will also begin applying scrutiny to arrangements that help an entity satisfy the turnover test to qualify for the JobKeeper payment.

“Integrity rules are in place to deny or reduce an entitlement to JobKeeper payments if schemes are contrived to ensure payment conditions are satisfied, such as temporarily reducing or deferring turnover. Exceeding your turnover predictions by itself does not trigger these integrity rules,” the ATO said.

“Our compliance focus will be particularly directed towards schemes where there has not been a genuine fall in turnover in substance, but arrangements are contrived to ensure the turnover test is satisfied.”

Jotham Lian

29 April 2020

smsfadvier.com

Latest eNewsletters

Hot Issues

- It’s super hump month. Make the most of it

- Three timeless investing lessons from Warren Buffett

- 2026 outlook: Economic upside, stock market downside

- Care needed with ceased legacy pensions

- What had the biggest impact on the sector in 2025?

- What does 2026 look like in the SMSF sector?

- It’s not just Div 296 that could face changes in 2026

- Which country produces the most electricity annually?

- AI exuberance: Economic upside, stock market downside

- Becoming a member of an SMSF is easy, but there are other things that need to be considered

- Investment and economic outlook, November 2025

- Move assets before death to avoid tax implications

- ATO issues warning about super schemes

- 12 financial tips for the festive season and year ahead

- Birth date impacts bring-forward NCCs

- Countries with the largest collection or eucalyptus trees

- How to budget using the envelope method

- Accountants united in support for changes

- Investment and economic outlook, October 2025

- Stress-test SMSF in preparation for Div 296

- Determining what is an in-house asset can help determine investment strategy

- Beware pushy sales tactics targeting your super

- Call for SMSF ‘nudge’ in DBFO package

- How Many Countries Divided From The Largest Empire throughout history

- How changes to deeming rates could affect your pension payments

- Five building blocks that could lead to a more confident retirement

- Investment and economic outlook, September 2025

- Caution needed if moving assets to children

- Evolution of ‘ageless workers’ sees retirement age rise

- Younger Australians expect more for their retirement