Tools for budgeting, cash flow, Super and more ….

Better financial management and improved financial literacy will help attainment your long-term goal. The resources in our Financial Tools will help. Available 24/7.

Don't ever do a Budget again on the back of an envelope or using anything hand written. Via this site's financial tools, secure client portal or calculators you and your family can access very good online resources AND all information is kept for re-use over and over again. Do the hack work once online and you only have to adjust data from then on. Great for your kids as well.

These tools are an added service to help you, our clients, gain more from what we provide.

You may think that working on a Budget or cash flow isn’t your cup of tea but when things are tight or you need to look long term there is no better way to manage how your money is used. 24/7 access and if you have a question you don't have far to go to ask.

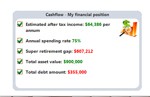

The following images are examples of what can be done, also there is a longer article about overall financial literacy following the first few points.

|  |

| Budget | Cash Flow |

| |

| Cash Flow Summary | |

| |

| Super | Super Optimiser |

When you feel the urge then a quick trip to our website is a good thing to do, it has all the tools you need and more. Also any information you add that’s relevant to other tools is automatically transferred saving you time and effort.

Give it a go. Start with a Budget or cash flow analysis or Super scenario. It may take a bit of time but even a few minutes here and there is good and everything you add will be waiting until the next time you log in.

Your Financial PlannerLatest eNewsletters

Hot Issues

- AI exuberance: Economic upside, stock market downside

- Becoming a member of an SMSF is easy, but there are other things that need to be considered

- Investment and economic outlook, November 2025

- Move assets before death to avoid tax implications

- ATO issues warning about super schemes

- 12 financial tips for the festive season and year ahead

- Birth date impacts bring-forward NCCs

- Countries with the largest collection or eucalyptus trees

- How to budget using the envelope method

- Accountants united in support for changes

- Investment and economic outlook, October 2025

- Stress-test SMSF in preparation for Div 296

- Determining what is an in-house asset can help determine investment strategy

- Beware pushy sales tactics targeting your super

- Call for SMSF ‘nudge’ in DBFO package

- How Many Countries Divided From The Largest Empire throughout history

- How changes to deeming rates could affect your pension payments

- Five building blocks that could lead to a more confident retirement

- Investment and economic outlook, September 2025

- Caution needed if moving assets to children

- Evolution of ‘ageless workers’ sees retirement age rise

- Younger Australians expect more for their retirement

- New NALE guidance still has issues

- Airplane Fuel Consumption Per Minute

- How $1,000 plus regular contributions turned into $823,000 through compounding