Bull vs Bear

An explanation of the difference between a Bull and Bear run.

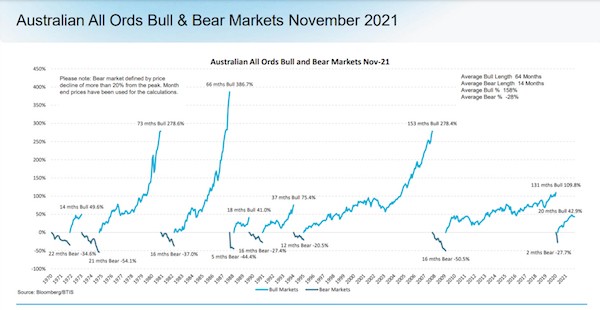

The terms ‘Bull’ market and ‘Bear’ market are always in the news and most know what they

mean, though a brief definition is noted below. The point of this chart is to allow us to see

more detail on Bull and Bear periods in regard to the Australian All Ords since 1970. A

quick snapshot, but interesting.

What is a bull market?

A market is referred to as a ‘bull’ market when the share market is showing confidence. It is

essentially a market in which share prices continue to rise, encouraging buying. After a

sustained period of increasing share prices, investors gain faith that the uptrend will continue

in the long-term. In a typical bull-market, the country’s economy is strong and

unemployment is low.

A market may be called a bull market after a number of ‘bullish’ days in succession, but the

technical criteria for a bull market is a rise in the value of the market by 20%.

What is a bear market?

‘Bear’ markets are the opposite of bull markets, and while there’s no hard and fast rule, the

generally-accepted definition is that they occur when the markets fall by more than 20%. In

bear markets, the prices of securities are falling, and widespread pessimism among investors

caused by the falling prices leads to self-sustaining negative sentiment.

Latest eNewsletters

Hot Issues

- ASIC targeting high-pressure sales and inappropriate advice

- Investment and economic outlook, January 2026

- Australians not underspending their super

- Five financial steps for the new year

- ASIC warns investors on pump and dump scammers

- Don’t confuse contribution with roll-over when using proceeds from small business sale

- Missed SG exemption may not be problem

- Rare and vanishing: Animals That May Go Extinct Soon

- It’s super hump month. Make the most of it

- Three timeless investing lessons from Warren Buffett

- 2026 outlook: Economic upside, stock market downside

- Care needed with ceased legacy pensions

- What had the biggest impact on the sector in 2025?

- What does 2026 look like in the SMSF sector?

- It’s not just Div 296 that could face changes in 2026

- Which country produces the most electricity annually?

- AI exuberance: Economic upside, stock market downside

- Becoming a member of an SMSF is easy, but there are other things that need to be considered

- Investment and economic outlook, November 2025

- Move assets before death to avoid tax implications

- ATO issues warning about super schemes

- 12 financial tips for the festive season and year ahead

- Birth date impacts bring-forward NCCs

- Countries with the largest collection or eucalyptus trees

- How to budget using the envelope method

- Accountants united in support for changes