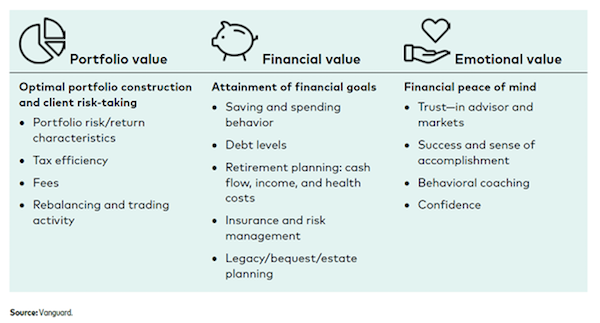

How advice gets you closer to your goals

A recent Vanguard survey found that investors believed financial advice provides substantial portfolio, financial and emotional value, and got them closer to achieving their financial goals.

A recent Vanguard survey asked over 1,500 investors in the U.S. if they believed financial advisers add value, and more specifically, how much value in dollar terms.

It found that across the board, regardless of whether the advice was delivered by a human or via a digital channel, investors believed advice provided substantial portfolio, financial and emotional value, and got them closer to achieving their financial goals.

Here’s a breakdown:

Portfolio Value

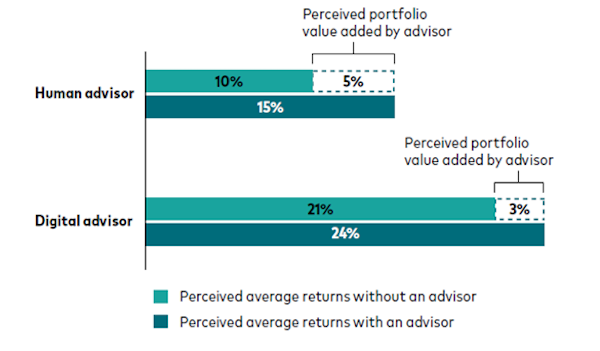

Investors were asked two questions: 1) what they believe their investment performance was with a financial adviser and 2) what they believe it would have been without one.

The results were that human-advised clients believed their advisers added 5 per cent to their annual portfolio performance, while digital-advised clients believed advice added 3 per cent.

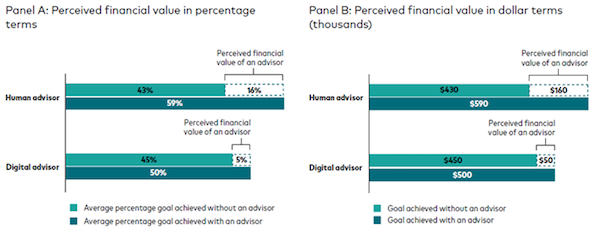

Financial Value

Investors also believe advice provides high financial value, with human-advised clients perceiving advice to add 16 per cent to their attainment of financial goals.

In dollar terms, this means clients with the median financial goal of one million dollars will be $160,000 closer to achieving it compared to unadvised investors.

For digital-advised clients, they believed advice to contribute 5 per cent to their attainment of financial goals, meaning they were $50,000 closer to achieving one million dollars than if they didn’t seek advice.

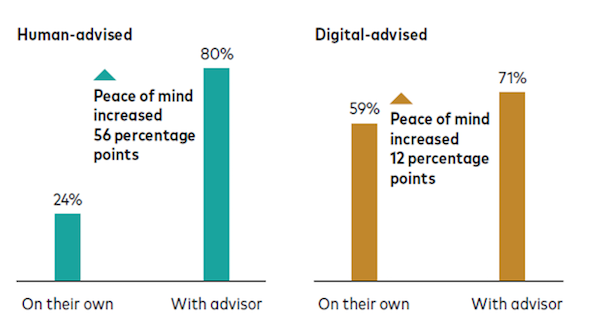

Emotional Value

The financial choices households must make have become more complex over time. By their nature, financial markets tend to be volatile, which may make investors anxious during market corrections. Trusted advice in times like these improves more than just returns, but it can also provide financial peace of mind and keep investors on track to achieve their goals.

It was found that human-advised clients reported a 56 per cent increase in their peace of mind when they engaged the services of a financial adviser. Digital-advised clients reported a 12 per cent increase.

Advisers add value

It’s evident from this research that investors derive significant value from financial advice and can greatly benefit from the investment expertise and coaching that professional guidance can offer.

From improving investment returns to achieving individual goals to emotional reassurance, financial advisers can support you on your investment journey.

Vanquard

20 Apr, 2022

vanguard.com.au

Latest eNewsletters

Hot Issues

- AI exuberance: Economic upside, stock market downside

- Becoming a member of an SMSF is easy, but there are other things that need to be considered

- Investment and economic outlook, November 2025

- Move assets before death to avoid tax implications

- ATO issues warning about super schemes

- 12 financial tips for the festive season and year ahead

- Birth date impacts bring-forward NCCs

- Countries with the largest collection or eucalyptus trees

- How to budget using the envelope method

- Accountants united in support for changes

- Investment and economic outlook, October 2025

- Stress-test SMSF in preparation for Div 296

- Determining what is an in-house asset can help determine investment strategy

- Beware pushy sales tactics targeting your super

- Call for SMSF ‘nudge’ in DBFO package

- How Many Countries Divided From The Largest Empire throughout history

- How changes to deeming rates could affect your pension payments

- Five building blocks that could lead to a more confident retirement

- Investment and economic outlook, September 2025

- Caution needed if moving assets to children

- Evolution of ‘ageless workers’ sees retirement age rise

- Younger Australians expect more for their retirement

- New NALE guidance still has issues

- Airplane Fuel Consumption Per Minute